The Great Capital Migration

Every quarter, Wall Street performs the same ritual. Analysts armed with spreadsheets debate whether electric vehicle penetration will hit 25% or 35% by 2030. They model how many Nvidia chips AI data centers will consume over the next decade. Fund managers pontificate about peak oil demand—will the world burn more or less crude in 2050? Conference calls overflow with discussions of addressable markets, demographic shifts, and long-term growth trajectories.

Meanwhile, a handful of investors ignore these forecasting exercises entirely. While the investment world obsesses over demand forecasting (a fool’s errand), smart money analyzes where money is flowing today, and its impact on future demand.

This difference in approach explains why most investors get blindsided by industry booms and busts that, in hindsight, seem entirely predictable.

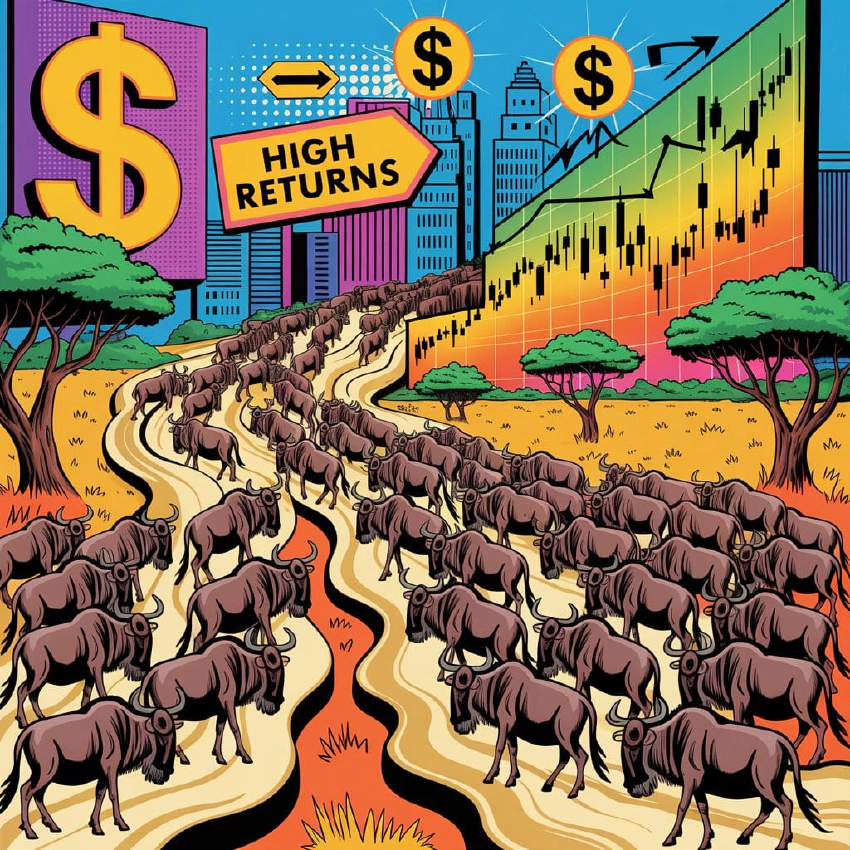

Welcome to the Great Capital Migration—Wall Street’s most reliable pattern and perhaps the most observable phenomenon in modern markets. Like wildebeest following ancient routes across the Serengeti, capital flows in massive herds along predictable paths, driven by the eternal search for returns.

The premise is simple. The promise of high returns attract capital like watering holes attract thirsty herds. The reality of low returns repel it like drought drives animals to new territories. This creates competitive dynamics that unfold with seasonal precision, yet most participants remain oblivious to the patterns beneath their feet.

Why? Because humans prefer compelling stories to observable behavior. The Great Capital Migration follows natural instincts. And natural instincts always prevail.

The Battery Wars

It’s 2021. Meet Quantum Battery Systems—a fictional lithium-ion battery manufacturer having its moment. The CEO lands on Forbes’ cover (red flag). Investment bankers circle. Most analysts issue “Strong Buy” ratings. The stock trades at attractive multiples—a “reasonable discount,” according to research reports.

Management paints boundless opportunity: electric vehicle adoption will require exponentially more battery capacity than currently exists. Plans emerge for massive production expansion over the next few years. A secondary offering funds growth, and shares surge. The EV revolution demands it.

Fast-forward several years: Bloomberg reports the CEO’s “resignation” amid activist pressure. The stock has cratered significantly. Profits evaporated. Multiple competitors expanded simultaneously, flooding markets with battery capacity nobody ordered at prices that make little sense. Few analysts still cover the stock—most with sell ratings.

“Near-term visibility remains limited,” reads the final research note. Corporate speak for “we have no idea.”

This boom-bust sequence isn’t fiction—it’s capitalism’s most reliable migration pattern. Industries from semiconductors to airlines follow these routes with seasonal regularity. Yet participants always act shocked by entirely predictable outcomes.

The Psychology of Predictable Herding

What drives this migratory behavior? A cocktail of human psychology and institutional incentives that virtually guarantees the migration repeats.

Think Cathie Wood in her COVID heyday versus the abysmal returns Ark Invest has returned to investors since then.

Extrapolation bias: Humans project recent trends indefinitely. Several quarters of margin expansion become evidence of permanent advantage. We anchor on immediate experiences and draw sweeping conclusions from limited data.

What happened to all those predictions on the blockchain, NFTs, and the metaverse? How much investor capital was destroyed in the process?

Competition neglect: Companies analyze their own expansion plans carefully but systematically underestimate how many competitors harbor identical ambitions. The result—industry-wide overcapacity—surprises everyone focused exclusively on individual decisions.

Investment bankers accelerate these dynamics, earning fees from secondary offerings and IPOs funding expansion. Research analysts cover fast-growing sectors where banking fees hide. Neither has accountability for long-term outcomes.

Building capacity takes time—battery plants require years to construct, mining projects even longer. This lag means supply arrives in concentrated waves, massively overshooting just when demand moderates.

There are over 200 electric vehicle (EV) manufacturers in China! Would you have invested in a Chinese EV company 5 years ago if you knew there would be 200 today?

The wonderful irony? This psychological herding that destroys individual companies creates systematic opportunities for those positioning ahead of the migration rather than following it.

The Lithium Stampede

No better recent example exists than the lithium boom-bust of the late 2010s and early 2020s. As Tesla’s success sparked EV mania, lithium prices skyrocketed several times over in just a few years. Wall Street discovered lithium as the “white gold” of the future. Mining companies rebranded around battery metals overnight.

The narrative was intoxicating: exponential EV growth would create insatiable lithium demand. Limited brine deposits in Chile and Argentina created natural supply constraints. A new commodity super cycle—this time was different.

Lithium cost relatively little to extract from established operations, but spot prices reached stratospheric levels—margins that made software companies envious.

Natural economic forces predicted what followed. Lithium producers initially stayed cautious, having witnessed previous migrations. But as prices persisted above all reasonable metrics, the herd began moving. The great capital migration had begun. New mining projects launched globally. Venture capital flooded battery startups. Every auto manufacturer announced multi-billion-dollar battery investments.

Meanwhile, demand assumptions proved optimistic. EV adoption, while growing rapidly, hit infrastructure constraints and consumer resistance. Supply chain bottlenecks delayed projects. Most critically, recycling technology improved faster than expected, reducing virgin material needs.

By 2023, lithium prices had crashed dramatically from peak levels. The migration had reached its inevitable conclusion. Mining stocks fell even harder. The “white gold” narrative collapsed under predictable oversupply arriving just as demand growth moderated.

The lesson remains unchanged. It operates with migratory precision, yet participants rediscover it painfully each journey.

“There is no cure for high prices, like high prices.”

Digital Moats and Safe Havens

Not every business succumbs to the great migration patterns. Some transcend traditional competition by building “digital moats”—network effects and switching costs creating sustainable refuges that capital herds cannot easily penetrate.

Consider Amazon in 2007. The company showed minimal profitability, with margins fluctuating wildly as it reinvested heavily in new services. Wall Street punished this “inefficiency,” driving shares down significantly despite revenue growth exceeding 30% annually.

Sophisticated investors recognized strategic brilliance where others saw poor execution. Amazon was sacrificing short-term profits to build unassailable positions in e-commerce, cloud computing, and logistics—territories that would prove nearly impossible for herds to overrun.

The Internet had created winner-take-all dynamics traditional theory hadn’t incorporated. Network effects generated increasing rather than diminishing returns. Customer acquisition costs fell as user bases expanded. Data advantages compounded over time.

But timing mattered crucially. Amazon’s cloud advantage came partly from establishing territory before venture capital herds flooded the market with dozens of competitive offerings.

Industries illustrate this perfectly across sectors. While traditional manufacturing companies suffer violent migrations, specialized technology producers can maintain exceptional margins for decades. Their secret: product complexity requiring specialized expertise taking years to develop—natural barriers capital herds alone couldn’t overcome.

Navigation Strategy

Successfully tracking the Great Capital Migration demands systematic observation and behavioral discipline.

- Early migration features rising prices, improving conditions, initial movement announcements.

- Late migration shows explosive growth, euphoric coverage, maximum herd size.

- Peak migration brings optimism despite emerging resource constraints.

Successfully playing this strategy requires modest exposure given volatility and binary outcomes. Success often demands enduring significant drawdowns before vindication. Contrarian positioning creates social pressures testing conviction.

The Eternal Migration

The Great Capital Migration persists as long as humans remain susceptible to greed, fear, and herding instincts. Technology may compress timing and amplify outcomes, but fundamentals remain: abundant resources attract herds until they become scarce resources.

This creates systematic opportunities for patient observers positioning ahead of migration routes rather than following the stampede. The question isn’t whether migrations continue—natural behavior ensures they will. It’s whether investors maintain discipline to profit from predictable patterns rather than become victims.

In a world obsessed with narratives and forecasts, perhaps the greatest edge comes from following something as old as nature itself. Stories change, but herd behavior remains remarkably consistent.

“It’s not the pessimist who sounds smart that makes money—it’s the optimist who recognizes when the entire herd has become too optimistic.”