UnHappy Days

For those old enough to remember, there was an episode of Happy Days where the Fonz jumps over a shark on water skis. That episode coined the phrase “jumped the shark”—the moment when something popular gets so outlandish it’s lost the plot entirely, and you know things are about to go south.

Thursday morning–January 29, 2026–I woke up to a news bite: El Salvador just bought $50 million worth of gold.

Now, El Salvador is a small country. Fifty million isn’t going to move the global gold market. But this wasn’t central bank buying on a planned schedule—this was FOMO at the state level. When sovereign nations start FOMO-buying assets at all-time highs, you’re not early. You’re late. Very late.

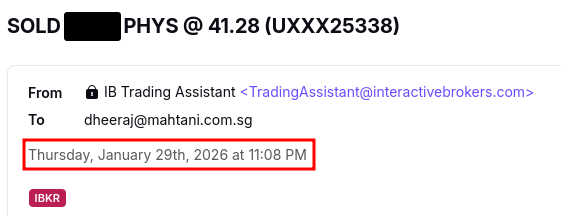

I knew right then the shark had been jumped, so I decided to sell my entire Gold position when the US markets opened. An hour after I sold, the precious metals started their collapse.

PHYS = Sprott Physical Gold Trust (NYSE). Singapore Timezone.

By Friday’s close, gold had surrendered $855 per ounce from Thursday’s peak. Silver cratered 31% in a single session. If you weren’t around for March 1980—and let’s be honest, most of us weren’t—this was your introduction to what happens when parabolic price action meets margin requirements, forced liquidation, and the sudden realization that maybe, just maybe, things had gotten a little ahead of themselves.

The Parabolic Setup

Silver gained nearly 300% in one year. It rallied 65% in January alone. Gold surged to $5,600. The rally had everything going for it on paper: a weakening dollar hitting four-year lows, central banks diversifying away from Treasury holdings, genuine industrial demand from AI data centers and solar panels, China restricting silver exports starting in January, geopolitical chaos from Venezuela to Iran.

Bank of America literally published a report calling silver the most “bubble-like” asset in the world, with prices roughly 30% above long-term fundamental averages. Citigroup was forecasting $150 silver within three months. The gold-silver ratio had compressed to 45:1—the lowest in 14 years.

Here’s what makes this interesting: all those fundamental drivers were real. The structural deficit in silver markets? Real. The AI infrastructure build-out requiring massive amounts of the metal? Real. De-dollarization and central bank buying? Also real.

But markets don’t care about your thesis when you’re overleveraged and over your skis.

March 27, 1980: The 45-Year Echo

The cruel irony is that we just passed the 45-year anniversary of the original Silver Thursday. On March 27, 1980, silver crashed from $21 to $10.80 after the Hunt Brothers—who’d tried to corner the market—couldn’t meet their margin calls.

In January 1980, COMEX raised margin requirements with “Silver Rule 7,” restricting margin purchases. The Hunts, who’d borrowed billions to finance their positions, couldn’t meet the calls. Forced liquidation triggered a cascade.

On December 29, 2025—just a month ago—the CME raised silver margins by 30%. Then they did it again on January 30, hiking margins another 36% for silver, 33% for gold. Same playbook, 45 years later.

When you’re leveraged to the hilt and the exchange forces you to post more collateral, you have two choices: come up with the cash or liquidate. Guess which one most traders chose on Friday?

The Warsh Catalyst: Not What You Think

The proximate trigger for Friday’s bloodbath was President Trump’s nomination of Kevin Warsh as the next Fed Chair. But here’s where the narrative gets interesting—and where most commentary gets it wrong.

Yes, Warsh has a “hawkish” reputation from his 2006-2011 Fed tenure when he worried about inflation even during the financial crisis. But recently he’s been arguing for LOWER rates, not higher ones. He wrote in the Wall Street Journal that inflation is falling and the Fed should cut rates. He believes AI productivity gains mean rates can come down without reigniting inflation.

So why did precious metals crash on his nomination?

Because the entire precious metals rally had been built on a dollar debasement trade. The thesis was simple: Trump will pressure the Fed to destroy the dollar, real rates will go deeply negative, there is no alternative to gold and silver.

Warsh’s nomination killed that narrative instantly. Not because he’ll keep rates higher for longer—he probably won’t. But because he represents currency stability and Fed independence. He’s not going to let the dollar collapse to please Trump, even if he cuts rates for legitimate economic reasons.

The Dollar Index, which had been languishing at four-year lows, pushed 0.6% higher. Treasury yields held. Every institutional fund riding the “dollar debasement” wave suddenly had to recalculate whether their position still made sense.

To some, it didn’t. So the exodus started.

Leverage: The Accelerant

Even a quick glance at the RSI or the 50-day exponential moving average would have screamed “overbought.” But retail doesn’t look at charts when FOMO is raging. They just keep piling in.

Meanwhile, January 30 was options expiry day—which always brings volatility as positions get unwound. You had institutional money managers sitting on fantastic returns for the month, the quarter, the year. Time to book those gains.

The combination was lethal: massively overleveraged retail longs, scheduled options expiry creating mechanical selling pressure, institutional profit-taking, and margin requirement hikes forcing liquidations. Retail walked into a buzzsaw.

Silver’s 36% intraday plunge was the worst since March 1980. Gold’s 12% drop was the biggest slide in four decades. That’s not sellers making a rational decision to take profits. That’s traders getting margin calls they can’t meet, brokers dumping positions into a thin market, and everyone scrambling for the exits at once.

The Lessons (That We’ll Ignore Next Time)

Parabolic moves end badly. A 65% gain in one month isn’t the beginning of something sustainable—it’s the end.

Margin is a double-edged sword. If your investment thesis requires borrowed money to work, you don’t have an investment thesis—you have a speculation that will eventually blow up.

When the exchange raises margins, that’s your exit signal. The casino just changed the rules. Time to leave the table.

“This time is different” is expensive. The fundamentals might be different. The geopolitical landscape might be different. The mechanics of leverage, greed, fear, and forced liquidation are exactly the same as 1980, 2011, and every bubble in between.

Sell when you don’t want to. When Citigroup is forecasting $150 silver and El Salvador is FOMO-buying at all-time highs, that’s your exit signal, not your entry.

Where I Stand: Watching for Re-Entry

Now that prices have returned to more reasonable levels, I’m watching for entries again. Why? Because nothing has fundamentally changed.

Are interest rates coming lower? Yes. That’s bullish for precious metals because the opportunity cost of holding them decreases.

Are governments reducing their spending? No. Deficits as far as the eye can see.

Has the world become more peaceful? We’ve got Russia-Ukraine approaching its fourth anniversary, tensions with Iran escalating, Taiwan inching closer to reunification with China (people now talking not if, but when), NATO hanging together by a thread…the list goes on.

So to me, the landscape for precious metals remains positive. All that happened was the market found an opportunity to clear out the leverage and wipe the floor with retail. And so it did.

The Charts: Where I’m Looking for Re-Entry

Here’s what I’m watching now for potential entry points. These are the technical setups that look interesting to me after the washout:

Key Support Levels (1-Day and 4-hour Chart)

Gold: The 50 EMA sits at $4,550. This is the critical support that needs to hold. If gold can find buyers here and hold above this level, we could see a healthy consolidation before the next leg. Below $4,550 and we’re looking at a more serious technical breakdown. Take a look at the RSI–overbought territory is above 70. On Thursday, Gold was at 90. That’s a bubble just waiting to pop. 😮

Silver: The 50 EMA is at $79. Same story—this needs to hold. A successful test and bounce off $79 would signal that the panic selling is over and we’re building a base. A break below takes us into much deeper correction territory.

I’m not rushing in. I’m waiting for the technical setup to confirm—a successful retest of these 50 EMA levels, reduced volatility, maybe some consolidation that shows the panic has truly subsided. The fundamentals support higher prices over time, but I need to see price respect these key moving averages and the leverage fully cleared out first. If I see bullish candle at the orange circles, that’s my entry. If not, I stand back and wait for the knife to keep dropping.

The Real Takeaway

Here’s what few are talking about: the fundamentals that drove precious metals higher are still intact. Maybe even stronger. But the market just reminded everyone of an uncomfortable truth—being right about the long-term thesis means nothing if you’re wrong about the short-term positioning.

The investors who got annihilated Friday weren’t wrong about de-dollarization, or industrial silver demand, or central bank buying. They were just late, overleveraged, and convinced the rally would never pause for breath. The market doesn’t care how compelling your thesis is when margin clerks start making calls.

This washout created something valuable: a reset. The tourists are gone. The leverage is unwound. The people left standing are the ones who understand that great trades require both the right thesis AND the right entry point.

The opportunity isn’t in the rally that just happened. It’s in the one that forms after everyone who was wrong about risk management has been flushed out.

The music always stops eventually. The question is whether you leave while it’s still playing, or are scrambling for the exit when all hell breaks loose.